The automotive industry is undergoing a significant transformation, and within it, car finance companies face increasing pressure to not only attract new customers but also cultivate lasting relationships. In this dynamic landscape, customer loyalty is no longer a luxury but a necessity. Just as car manufacturers and dealerships are embracing innovative strategies to retain customers, car finance companies are also recognizing the power of loyalty programs. But What Car Finance Companies Have Loyalty Programs, and how do these programs benefit both the lenders and borrowers?

This article delves into the world of loyalty programs offered by car finance companies, exploring their structure, benefits, key features, and the impact they have on customer retention and overall business success. Understanding these programs is crucial for both consumers seeking the best financing options and industry professionals aiming to enhance customer engagement and loyalty in the competitive automotive finance sector.

Understanding Automotive Loyalty in Finance

Automotive loyalty programs, in the context of finance, are customer retention strategies specifically designed by car finance companies. Unlike broader automotive loyalty programs that might encompass vehicle servicing or brand merchandise, finance loyalty programs are centered around the financial services provided during vehicle purchase. These programs aim to reward customers for their continued financial relationship, encouraging them to return for future financing needs and fostering a stronger bond with the lending institution.

These programs can take various forms, mirroring the diversity seen in general automotive loyalty. Here are some key types of loyalty programs that car finance companies might implement:

-

Point-Based Reward Systems: Customers earn points for various actions, primarily centered around responsible financial behavior. This could include:

- Making on-time monthly payments.

- Referring friends or family for financing.

- Maintaining a good credit score throughout the loan term.

- Taking out additional financial products offered by the company (like insurance).

These accumulated points can then be redeemed for tangible rewards like: - Discounts on future loan interest rates.

- Cashback rewards.

- Gift cards for automotive services or retailers.

- Waiving of certain fees (like late payment fees, within limits).

-

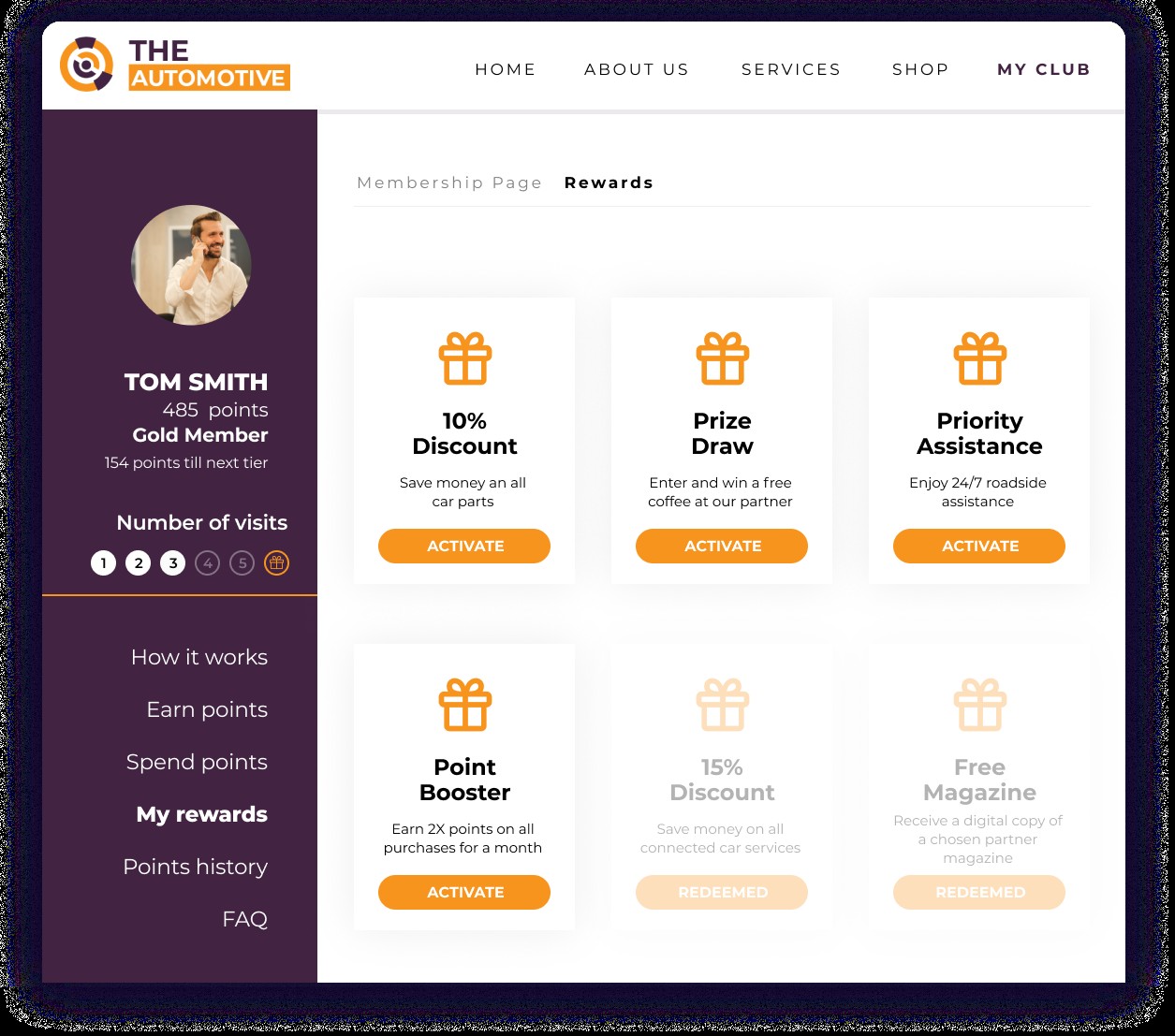

Tiered Loyalty Programs: Similar to airline or hotel loyalty programs, tiered systems offer increasing benefits as customers deepen their relationship with the finance company. Tiers could be based on:

- Number of loans financed through the company.

- Total value of loans financed.

- Length of customer relationship.

- Consistent on-time payment history.

Benefits at higher tiers might include: - Lower interest rates on subsequent loans.

- Faster loan approval processes.

- Personalized financial advice or services.

- Exclusive access to special financing offers.

- Priority customer service.

-

Perk-Based Loyalty Programs: These programs offer immediate, often non-financial, perks to loyal customers. These perks are designed to enhance the overall customer experience and can include:

- Complimentary credit score monitoring services.

- Discounts on vehicle insurance through partner companies.

- Access to financial education resources and workshops.

- Roadside assistance memberships.

- Concierge services for automotive needs (e.g., scheduling maintenance).

-

Partnership and Coalition Programs: Car finance companies can also partner with other businesses in the automotive ecosystem or beyond to expand the value of their loyalty programs. This might involve:

- Collaborations with insurance providers to offer bundled discounts.

- Partnerships with automotive service chains for discounted maintenance or repairs.

- Coalitions with retailers or travel companies to offer broader lifestyle rewards.

The membership page should also be designed in a way that instantly shows customers how they’re progressing towards rewards or new tiers.

Why Loyalty Matters for Car Finance Companies

The automotive finance sector is highly competitive, with numerous lenders vying for customer business. In this environment, acquiring new customers can be expensive, making customer retention a paramount concern. Loyalty programs provide a strategic advantage, offering several key benefits to car finance companies:

-

Increased Customer Retention and Repeat Business: A primary goal of any loyalty program is to encourage customers to return for future transactions. For car finance companies, this translates to customers choosing them again when they need to finance their next vehicle. By offering compelling rewards and benefits, these programs create a strong incentive for customers to stay within the lender’s ecosystem. Given the typically long purchase cycle in the automotive industry, nurturing long-term relationships is vital.

-

Reduced Default Rates: By rewarding responsible financial behavior like on-time payments, loyalty programs can indirectly contribute to lower default rates. Customers enrolled in these programs are incentivized to maintain a good payment history to accrue rewards and tier benefits, fostering a sense of responsibility and financial discipline.

-

Enhanced Customer Lifetime Value (CLTV): Loyal customers are generally more profitable over time. They are more likely to utilize additional services, are less price-sensitive, and often act as brand advocates. Loyalty programs help to maximize CLTV by fostering deeper engagement and encouraging repeat financing, leading to a more sustainable revenue stream.

-

Data Collection and Personalization Opportunities: Loyalty programs provide valuable data on customer behavior, preferences, and financial habits. This data can be leveraged to personalize communication, tailor financial product offerings, and enhance the overall customer experience. Personalized offers and communications, in turn, can further strengthen customer loyalty.

-

Competitive Differentiation: In a crowded market, a well-designed loyalty program can be a significant differentiator. It can attract new customers who are enticed by the prospect of rewards and benefits, and it can help retain existing customers by offering value that competitors may not provide. A robust loyalty program can become a key selling point, setting a finance company apart from the competition.

-

Positive Brand Image and Advocacy: A successful loyalty program enhances a company’s brand image, projecting a customer-centric approach. Satisfied loyalty program members are more likely to recommend the finance company to others, acting as powerful brand advocates and contributing to organic growth through word-of-mouth marketing.

BMW Digital Connect offers a wide range of built-in features in their cars that can be remotely activated in exchange for a subscription. In an automotive loyalty program, some of these could be added as high-value rewards.

Key Features of Effective Car Finance Loyalty Programs

For a car finance loyalty program to be successful and deliver the desired outcomes, several key features are crucial:

-

Simplicity and Ease of Understanding: The program structure, rules for earning rewards, and redemption process must be straightforward and easy for customers to understand. Complex or convoluted programs can lead to customer frustration and disengagement. Clear communication and transparent terms are essential.

-

Valuable and Relevant Rewards: The rewards offered must be genuinely valuable and relevant to the target audience. For car finance customers, financial incentives like interest rate discounts or cashback are particularly appealing. Perks that address common pain points, such as insurance discounts or roadside assistance, can also be highly effective.

-

Personalization: Leveraging customer data to personalize rewards and communications is key to enhancing program engagement. Tailoring offers based on individual customer profiles, past behavior, and preferences makes the program feel more relevant and valued.

-

Seamless Integration: The loyalty program should be seamlessly integrated into the customer journey, from loan application to repayment and beyond. Enrollment should be easy, and reward redemption should be convenient, ideally accessible through multiple channels (online, mobile app, in-person).

-

Multi-Channel Accessibility: Customers should be able to interact with the loyalty program through their preferred channels, whether it’s a dedicated mobile app, a website portal, or in-person interactions at a dealership or finance center. Omnichannel access ensures convenience and caters to diverse customer preferences.

-

Proactive Communication: Regular and proactive communication is vital to keep customers engaged with the loyalty program. This includes updates on earned points, available rewards, new program features, and personalized offers. Communication should be timely, relevant, and delivered through preferred channels.

-

Exceptional Customer Service: Underpinning any successful loyalty program is excellent customer service. Program members should have easy access to support for any queries or issues related to the program. Responsive and helpful customer service enhances the overall program experience and builds trust.

Examples and Adaptations for Car Finance Loyalty

While publicly available examples of standalone “car finance company loyalty programs” might be less prevalent than dealership or manufacturer programs, the principles and strategies are certainly applicable and adaptable. Finance arms of major automotive manufacturers (like Ford Credit, Toyota Financial Services, BMW Financial Services) often integrate loyalty benefits into the broader brand loyalty ecosystem.

Here’s how we can adapt examples from the original article and consider hypothetical programs directly focused on car finance:

-

Adapting FordPass for Ford Credit: Imagine FordPass extending beyond vehicle ownership to include financing benefits through Ford Credit. Customers financing through Ford Credit could earn points for on-time payments, which could then be redeemed for:

- Lower interest rates on their current or future Ford Credit loans.

- Discounts on vehicle protection plans offered by Ford.

- Credits towards future vehicle purchases financed through Ford Credit.

- Potentially even benefits within the broader FordPass ecosystem, like charging credits for electric vehicles or discounts on accessories.

-

BMW Inside Edge for BMW Financial Services: The perk-driven approach of BMW Inside Edge could be adapted to reward BMW Financial Services customers. Instead of just vehicle-related perks, consider financial perks:

- Exclusive access to financial planning webinars or consultations.

- Complimentary credit monitoring services.

- Partnerships with financial institutions to offer preferential rates on other financial products (mortgages, personal loans).

- Early access to special financing offers or lease deals.

-

Drawing Inspiration from Credit Card Rewards: Car finance companies can also draw inspiration from successful credit card loyalty programs. Features like cashback rewards for spending (in this case, for loan payments), travel rewards, or points multipliers for certain actions (like referrals) could be adapted to create compelling car finance loyalty programs.

-

Hypothetical “On-Time Payment Rewards” Program: A car finance company could implement a simple yet effective program that directly rewards on-time payments. For every consecutive 12 months of on-time payments, customers could receive:

- A small percentage reduction in their remaining interest rate.

- A cashback reward credited to their loan account.

- Points redeemable for gift cards or partner discounts.

- Waiving of a future late payment fee (as a one-time benefit).

Offering loyalty program members lenient expiration (especially in an automotive loyalty program) can go a long way, enticing people to choose this particular reward system.

Challenges and Considerations

Implementing and managing car finance loyalty programs also presents certain challenges and considerations:

-

Regulatory Compliance: Financial services are heavily regulated. Loyalty programs must be designed and operated in full compliance with all applicable laws and regulations, particularly those related to consumer finance, data privacy, and advertising.

-

Measuring ROI: Quantifying the return on investment (ROI) of loyalty programs in finance can be complex. Attributing increased customer retention or reduced default rates directly to the loyalty program requires careful tracking and analysis. Clear metrics and KPIs need to be established upfront to measure program effectiveness.

-

Data Security and Privacy: Loyalty programs involve collecting and processing customer data, including financial information. Robust data security measures and adherence to privacy regulations are paramount to protect customer data and maintain trust.

-

Program Complexity vs. Customer Engagement: Finding the right balance between program complexity and customer engagement is crucial. Overly complex programs can be confusing and deter participation, while overly simplistic programs might not offer enough value to drive loyalty.

-

Long Loan Terms and Sustained Engagement: Car loans often have long terms (several years). Maintaining customer engagement and program relevance over such extended periods requires ongoing effort, program updates, and proactive communication.

The Road Ahead for Car Finance Loyalty

As the automotive finance landscape evolves, loyalty programs are poised to become increasingly important for car finance companies. In a market driven by both price and customer experience, loyalty programs offer a powerful tool to differentiate, build stronger customer relationships, and drive sustainable business growth. By focusing on valuable rewards, personalized experiences, and seamless program integration, car finance companies can effectively leverage loyalty programs to answer the question of what car finance companies have loyalty programs with a resounding and beneficial “Ours does, and here’s why it’s better for you.”

For car finance companies looking to thrive in the future, understanding and implementing effective loyalty strategies is no longer optional – it’s a crucial element for long-term success and customer advocacy.